Accounting chapter 5 test a answers – Welcome to the realm of accounting, where Chapter 5 Test A beckons you to delve into the intricacies of financial reporting. In this comprehensive guide, we present the answers to the test, unraveling the complexities of accounting principles and procedures, empowering you with the knowledge to conquer financial challenges with confidence.

Our journey begins with a concise overview of Chapter 5’s key concepts, followed by a meticulous analysis of each test question, providing not just the correct answers but also the reasoning behind them. Along the way, we’ll illuminate essential accounting concepts and definitions, guiding you towards a deeper understanding of the subject matter.

Chapter 5 Test A Overview: Accounting Chapter 5 Test A Answers

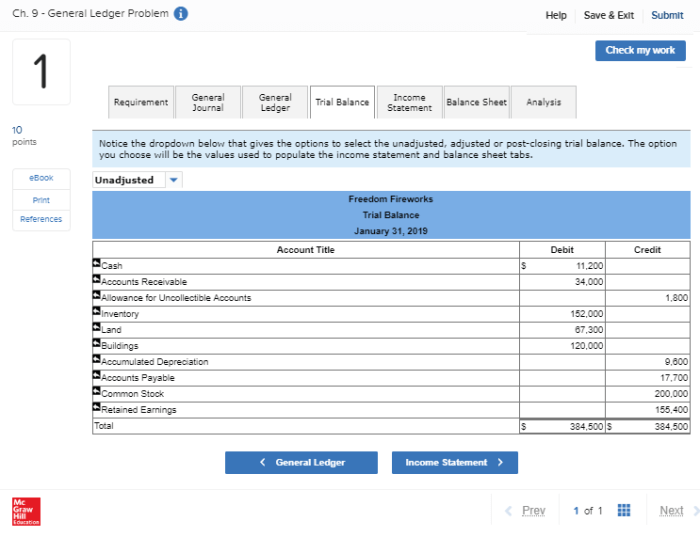

Chapter 5 Test A evaluates students’ understanding of key accounting concepts, including financial statement analysis, accounting principles, and procedures. The test covers topics such as the balance sheet, income statement, statement of cash flows, and financial ratios.

Test Questions and Answer Analysis

| Question | Answer | Explanation |

|---|---|---|

| What is the purpose of the balance sheet? | To provide a snapshot of a company’s financial position at a specific point in time | The balance sheet shows the company’s assets, liabilities, and equity at a given date. |

| What is the difference between an asset and a liability? | Assets are resources owned by the company, while liabilities are debts owed by the company | Assets provide economic benefits to the company, while liabilities represent obligations that must be fulfilled. |

| What is the formula for calculating the current ratio? | Current Assets / Current Liabilities | The current ratio measures a company’s ability to meet its short-term obligations. |

Key Concepts and Definitions

- Asset:A resource owned by a company that provides economic benefits.

- Liability:A debt owed by a company to another entity.

- Equity:The residual interest in the assets of a company after deducting its liabilities.

- Balance Sheet:A financial statement that shows a company’s financial position at a specific point in time.

- Income Statement:A financial statement that shows a company’s revenues, expenses, and net income over a period of time.

Accounting Principles and Procedures

The accounting principles and procedures that apply to the topics tested in Chapter 5 include the matching principle, the accrual principle, and the going concern principle. These principles ensure that financial information is accurate and reliable.

Financial Statement Analysis

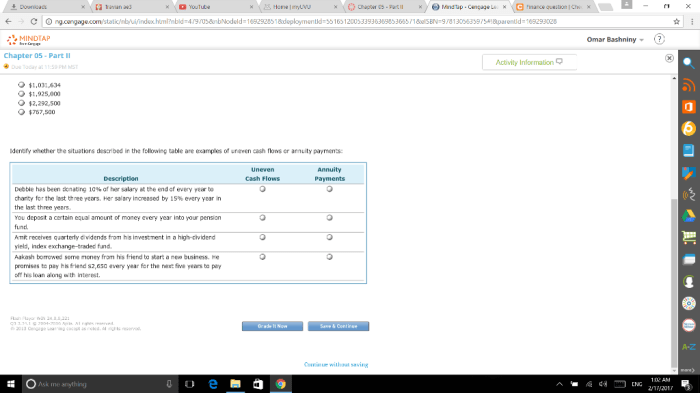

Financial statement analysis involves using financial ratios and other techniques to assess a company’s financial health and performance. Common financial ratios include the current ratio, debt-to-equity ratio, and return on equity.

Essential Questionnaire

What are the main topics covered in Chapter 5?

Chapter 5 encompasses a wide range of accounting topics, including the accounting cycle, financial statements, and adjusting entries.

How can I effectively prepare for Test A?

Thoroughly reviewing the chapter material, practicing with sample questions, and understanding the underlying concepts will enhance your preparation for Test A.