The chart shows the marginal cost of producing apple pies, a topic of great significance in the realm of economics. This detailed analysis delves into the intricacies of marginal cost, exploring its calculation, influential factors, and practical applications in apple pie production, providing valuable insights for decision-makers.

Overview of the Marginal Cost Curve

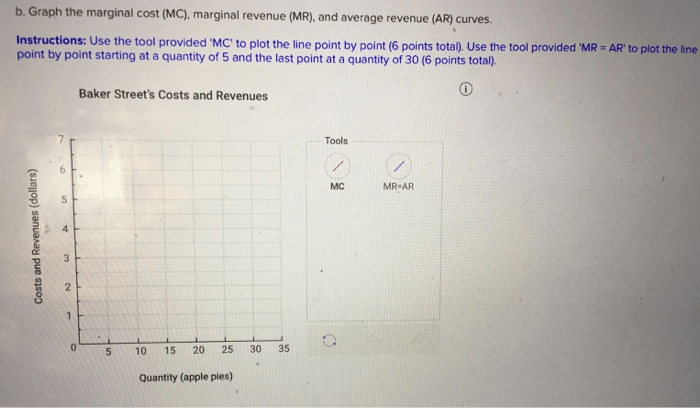

The marginal cost curve illustrates the change in total cost that results from producing one additional unit of output. It is calculated by dividing the change in total cost by the change in output. The marginal cost curve can be represented graphically, with the x-axis representing the quantity of output and the y-axis representing the marginal cost.

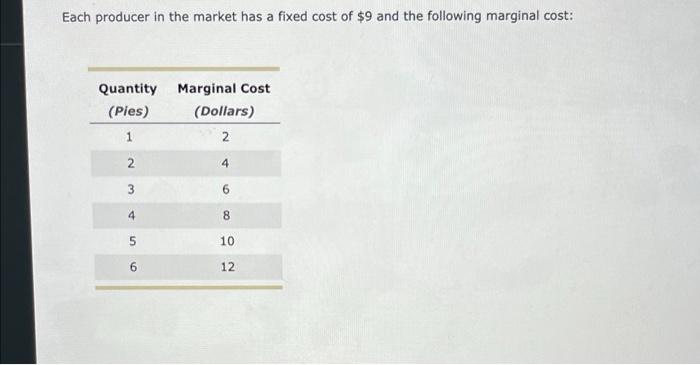

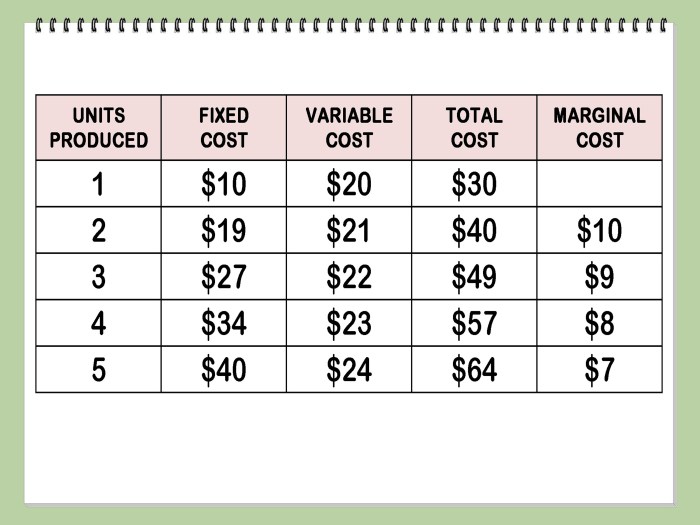

The following table shows the marginal cost of producing apple pies:

| Quantity | Total Cost | Marginal Cost |

|---|---|---|

| 0 | $100 | – |

| 1 | $150 | $50 |

| 2 | $200 | $50 |

| 3 | $250 | $50 |

| 4 | $300 | $50 |

Factors Affecting Marginal Cost

Several factors can affect the marginal cost of production, including:

- Input costs:The cost of raw materials, labor, and other inputs used in production can affect the marginal cost. If input costs increase, the marginal cost will also increase.

- Technology:Advances in technology can reduce the marginal cost of production by making it more efficient to produce goods and services.

- Economies of scale:As a firm produces more output, it may be able to achieve economies of scale, which can reduce the marginal cost of production.

- Learning curve:As workers become more experienced in producing a good or service, the marginal cost of production may decrease.

Relationship between Marginal Cost and Production Level

The marginal cost curve typically slopes upward as the production level increases. This is because as a firm produces more output, it becomes more difficult to find additional inputs at the same cost. As a result, the marginal cost of production increases.

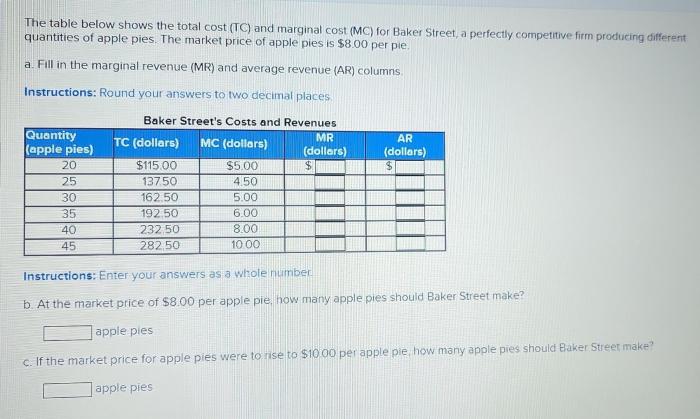

The relationship between marginal cost and production level has important implications for production decisions. Firms will typically produce output up to the point where the marginal cost equals the marginal revenue.

Applications of Marginal Cost Analysis: The Chart Shows The Marginal Cost Of Producing Apple Pies

Marginal cost analysis can be used in a variety of decision-making situations, including:

- Pricing decisions:Firms can use marginal cost analysis to help set prices for their products and services.

- Production planning:Firms can use marginal cost analysis to help determine the optimal level of output to produce.

- Investment decisions:Firms can use marginal cost analysis to help evaluate the profitability of potential investments.

Limitations of Marginal Cost Analysis

Marginal cost analysis is a useful tool, but it has some limitations. These limitations include:

- Fixed costs:Marginal cost analysis does not take into account fixed costs, which do not change with the level of output.

- Uncertainty:Marginal cost analysis is based on assumptions about the future, which may not always be accurate.

- Time:Marginal cost analysis can be time-consuming, which may not be practical for all decision-making situations.

FAQ Resource

What is marginal cost?

Marginal cost refers to the additional cost incurred by producing one more unit of a good or service.

How is marginal cost calculated?

Marginal cost is calculated by dividing the change in total cost by the change in quantity produced.

What factors can affect marginal cost?

Factors that can affect marginal cost include input costs, technology, economies of scale, and production efficiency.