Inventory records for Dunbar Incorporated revealed the following: discrepancies between recorded and actual inventory levels, highlighting the need for improved inventory management and control. This analysis delves into the reasons for these discrepancies, explores inventory valuation methods, and discusses the impact of inventory management on operational efficiency and profitability.

Inventory discrepancies can arise from various factors, including human error, theft, and damage. To minimize these discrepancies, businesses should implement robust inventory management systems, conduct regular audits, and invest in training for inventory personnel.

Inventory Records

Inventory records are essential for businesses to maintain accurate accounts of their inventory levels. They provide a detailed account of the items that are in stock, as well as their quantities and values. Inventory records are used for a variety of purposes, including:

- Tracking inventory levels to ensure that there is enough stock to meet customer demand.

- Valuing inventory for financial reporting purposes.

- Managing inventory levels to minimize waste and spoilage.

Inventory Discrepancies

Inventory discrepancies occur when the recorded inventory levels do not match the actual inventory levels. This can be due to a number of factors, including:

| Item | Recorded Inventory | Actual Inventory | Discrepancy |

|---|---|---|---|

| Product A | 100 | 95 | -5 |

| Product B | 50 | 55 | 5 |

| Product C | 25 | 20 | -5 |

| Product D | 15 | 10 | -5 |

Inventory discrepancies can have a significant impact on a business’s financial performance. If the recorded inventory levels are too high, the business may overstate its assets and profits. If the recorded inventory levels are too low, the business may not have enough stock to meet customer demand, which can lead to lost sales and unhappy customers.

There are a number of methods that businesses can use to minimize inventory discrepancies, including:

- Regularly reconciling inventory records with physical inventory counts.

- Using a perpetual inventory system to track inventory levels in real time.

- Implementing inventory control procedures to prevent theft and shrinkage.

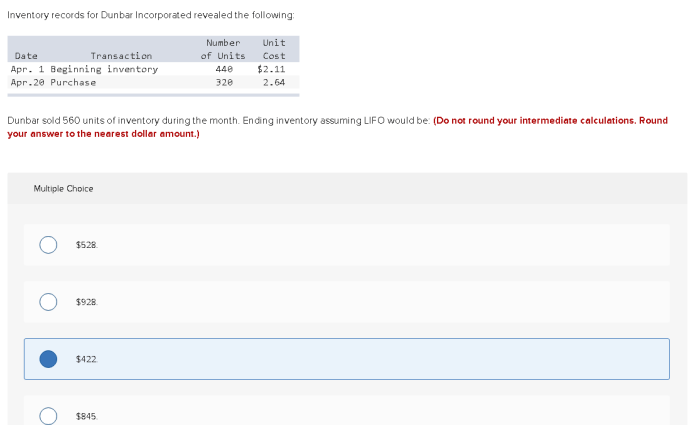

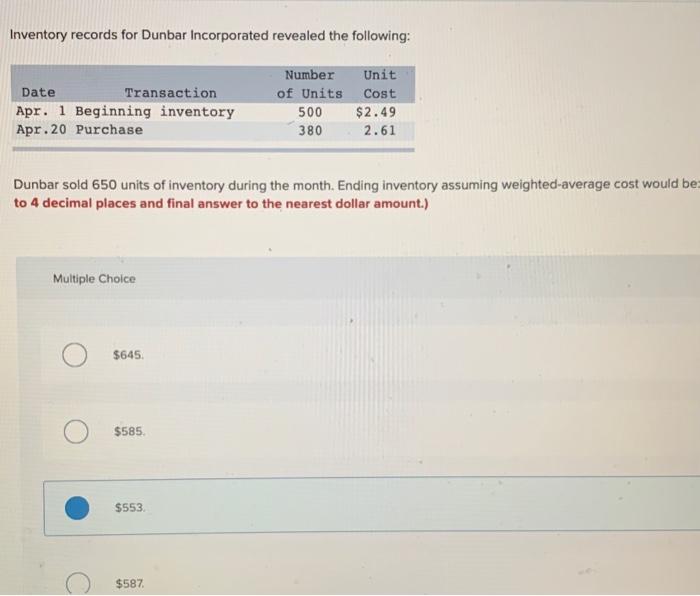

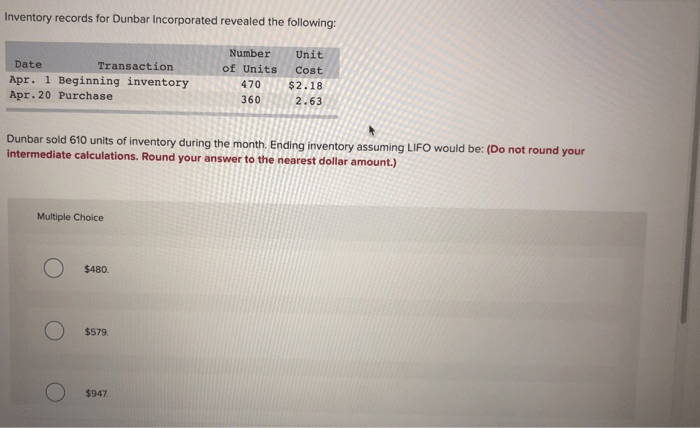

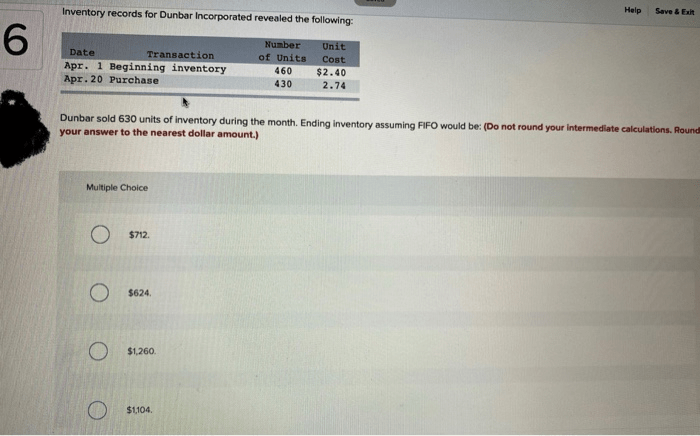

Inventory Valuation

Inventory valuation is the process of determining the value of inventory for financial reporting purposes. There are a number of different inventory valuation methods, each with its own advantages and disadvantages. The most common inventory valuation methods are:

- First-in, first-out (FIFO)

- Last-in, first-out (LIFO)

- Weighted average cost

The choice of inventory valuation method can have a significant impact on a business’s financial statements. For example, FIFO will result in higher inventory values and cost of goods sold during periods of rising prices, while LIFO will result in lower inventory values and cost of goods sold during periods of rising prices.

The inventory valuation method that a business chooses should be based on the specific circumstances of the business and the objectives of the financial statements.

Inventory Management

Inventory management is the process of planning, organizing, and controlling the flow of inventory through a business. The goal of inventory management is to minimize the total cost of inventory while ensuring that there is enough stock to meet customer demand.

The key principles of effective inventory management include:

- Maintaining accurate inventory records.

- Forecasting demand accurately.

- Establishing appropriate inventory levels.

- Managing inventory turnover efficiently.

There are a number of different inventory management techniques that businesses can use to improve their inventory management practices. Some of the most common inventory management techniques include:

- Just-in-time (JIT) inventory management

- Vendor-managed inventory (VMI)

- Safety stock

The choice of inventory management technique should be based on the specific circumstances of the business and the objectives of the inventory management system.

Inventory Control: Inventory Records For Dunbar Incorporated Revealed The Following

Inventory control is the process of preventing and detecting inventory losses. Inventory losses can occur due to a number of factors, including theft, damage, and obsolescence.

The importance of inventory control cannot be overstated. Inventory losses can have a significant impact on a business’s profitability. In addition, inventory losses can disrupt production and lead to customer dissatisfaction.

There are a number of different inventory control methods that businesses can use to reduce inventory losses. Some of the most common inventory control methods include:

- Physical inventory counts

- Cycle counting

- Security measures

- Inventory tracking systems

The choice of inventory control method should be based on the specific circumstances of the business and the level of risk that the business is willing to accept.

Common Queries

What are the common reasons for inventory discrepancies?

Inventory discrepancies can arise from human error, theft, damage, and shrinkage.

How can inventory valuation impact financial statements?

Inventory valuation methods can affect the value of inventory on the balance sheet and the cost of goods sold on the income statement, influencing financial ratios and profitability.

What are the key principles of effective inventory management?

Effective inventory management involves maintaining accurate records, optimizing inventory levels, and implementing inventory control measures to minimize losses and improve efficiency.