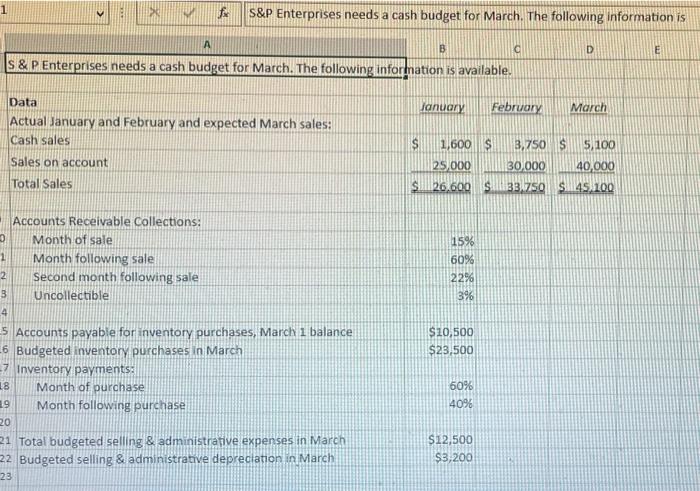

S&p enterprises needs a cash budget for march – S&P Enterprises requires a cash budget for March, a crucial step in ensuring the company’s financial stability and growth. A cash budget provides a comprehensive overview of the company’s cash inflows and outflows, enabling effective planning and decision-making.

Understanding the company’s current cash flow situation, including major sources and uses of cash, is essential for creating an accurate cash budget. This involves analyzing historical cash flow data, identifying trends, and projecting future cash flows.

Cash Flow Analysis

S&P Enterprises’ cash flow analysis provides insights into the company’s ability to generate and manage cash. The analysis includes an overview of current cash flow, identification of major sources and uses of cash, and assessment of cash flow trends.

S&P Enterprises’ cash inflows primarily consist of sales revenue, while cash outflows include operating expenses, capital expenditures, and debt repayments. Understanding the company’s cash flow patterns helps in forecasting future cash needs, identifying potential cash flow challenges, and implementing appropriate cash management strategies.

Cash Flow Statement

The cash flow statement categorizes cash flows into three main activities: operating, investing, and financing. The operating activities section captures cash generated from core business operations, while the investing activities section includes cash flows related to capital expenditures and acquisitions.

The financing activities section reflects cash flows from debt issuance, equity issuance, and dividend payments.

By analyzing the cash flow statement, S&P Enterprises can gain insights into its cash generation capacity, investment decisions, and financing strategies.

Cash Budget Creation

A cash budget is a financial plan that forecasts cash inflows and outflows over a specific period, typically a month or a quarter. It helps businesses anticipate potential cash shortfalls or surpluses, enabling them to make informed decisions regarding cash management.

Steps in Creating a Cash Budget

- Gather historical cash flow data

- Forecast future cash inflows and outflows

- Estimate beginning and ending cash balances

- Identify potential cash flow challenges or opportunities

- Develop cash management strategies

S&P Enterprises can use various forecasting techniques to estimate future cash flows, such as trend analysis, seasonal adjustments, and regression analysis. Assumptions regarding sales growth, expense levels, and investment plans should be clearly stated and justified.

March Cash Budget Forecast

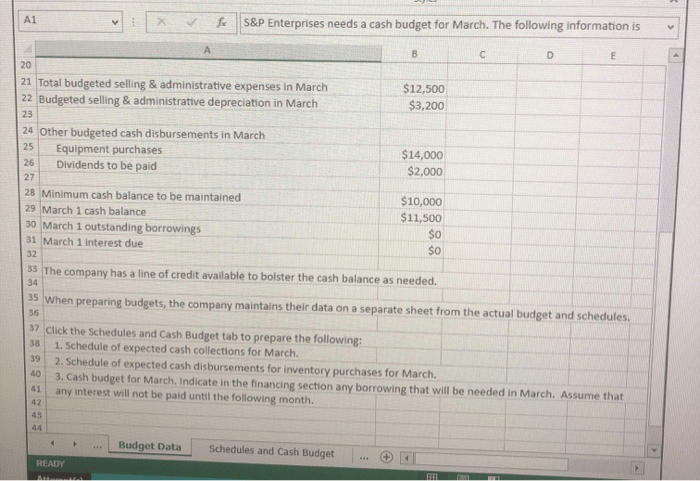

The March cash budget forecast for S&P Enterprises projects a beginning cash balance of $500,000. Total cash inflows for the month are estimated to be $1,200,000, primarily from sales revenue and accounts receivable collections. Total cash outflows are projected to be $1,100,000, including operating expenses, capital expenditures, and debt repayments.

Based on these projections, S&P Enterprises is expected to have an ending cash balance of $600,000 for March. This positive cash flow indicates that the company has sufficient liquidity to meet its current obligations and invest in future growth.

Potential Cash Flow Challenges

The cash budget identifies a potential cash flow challenge in the second week of March, when a large payment for equipment is due. To address this, S&P Enterprises is considering negotiating extended payment terms with the supplier or exploring alternative financing options.

Cash Flow Management Strategies: S&p Enterprises Needs A Cash Budget For March

To optimize cash flow, S&P Enterprises can implement various cash flow management strategies:

- Adjusting payment terms with suppliers and customers

- Negotiating discounts for early payments

- Managing inventory levels to reduce carrying costs

- Seeking additional financing, such as a line of credit or working capital loan

- Investing excess cash in short-term, liquid assets

The specific strategies adopted by S&P Enterprises will depend on its financial situation, industry dynamics, and risk tolerance.

Recommended Strategies

Based on S&P Enterprises’ current cash flow position and growth plans, the following strategies are recommended:

- Negotiate extended payment terms with the equipment supplier

- Explore invoice factoring to accelerate accounts receivable collections

- Consider a small business loan to bridge the cash flow gap during the second week of March

These strategies aim to improve cash flow liquidity, reduce financing costs, and support the company’s growth initiatives.

Cash Flow Monitoring and Reporting

Regular monitoring and reporting of cash flow are crucial for S&P Enterprises to maintain financial stability and make informed decisions. Key metrics to track include:

- Cash flow from operations

- Free cash flow

- Days sales outstanding (DSO)

- Days payable outstanding (DPO)

These metrics provide insights into the company’s ability to generate cash from operations, manage working capital, and assess its payment and collection practices.

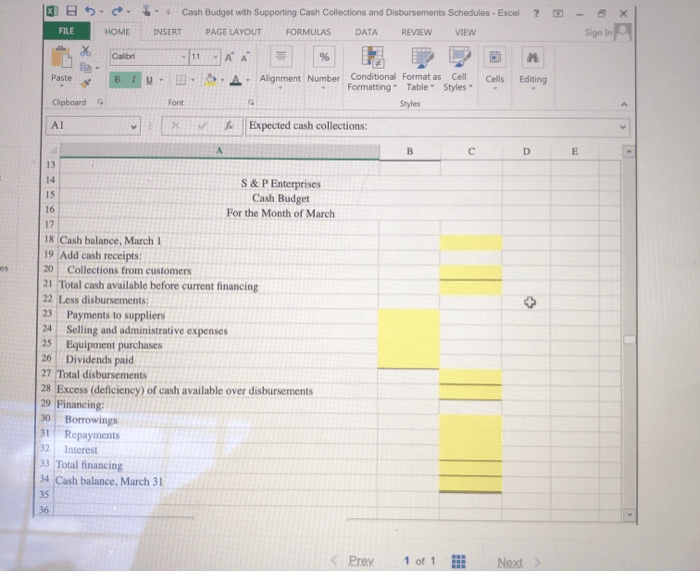

Cash Flow Reporting Template, S&p enterprises needs a cash budget for march

S&P Enterprises should develop a cash flow reporting template that includes the following information:

- Actual vs. budgeted cash flows

- Key performance indicators (KPIs) and metrics

- Analysis of variances and trends

- Recommendations for improvement

Regular reporting and analysis of cash flow data will enable S&P Enterprises to identify areas for improvement, optimize cash management practices, and mitigate potential cash flow risks.

Helpful Answers

What is the purpose of a cash budget?

A cash budget provides a detailed projection of a company’s cash inflows and outflows over a specific period, typically a month or a quarter. It helps businesses plan for future cash needs, identify potential cash flow challenges, and make informed financial decisions.

What are the key elements of a cash budget?

A cash budget typically includes projections for cash receipts, cash disbursements, and ending cash balance. It may also include assumptions about future sales, expenses, and other cash flow-related activities.

How can a company improve its cash flow?

There are several strategies that companies can implement to improve their cash flow, such as adjusting payment terms with customers and suppliers, negotiating discounts on purchases, and exploring alternative financing options.